The Hidden Dangers of Bad Bookkeeping in Home Services

Untended bookkeeping can lead to costly mistakes. Above: A small business owner reviewing QuickBooks financial records.

Home service business owners are experts at delivering quality work—fixing AC units, landscaping yards, repairing plumbing—but behind the scenes, bookkeeping often gets neglected. In the rush of daily operations, it’s easy to assume your invoicing app and accounting software are “taking care of the numbers.” Unfortunately, that assumption can backfire. Many Orange County home service companies have learned the hard way that bad bookkeeping practices (especially when different systems like scheduling software and QuickBooks aren’t perfectly in sync) can produce phantom income and other hidden dangers. Imagine paying taxes on revenue you never actually received, or worse—anger a loyal client by demanding a payment they already made. These scenarios aren’t just hypotheticals; they happen far too often due to bookkeeping errors that fly under the radar.

In this article, we’ll explore how seemingly minor bookkeeping issues—like syncing glitches between your field service management tool (e.g. a scheduling/invoicing app) and QuickBooks—can snowball into false revenue figures, inflated profits, and major tax liabilities. We’ll also look at how these errors can harm your customer relationships and even stunt your business’s growth. Most importantly, we’ll highlight best practices to reconcile your systems and keep your financial reporting accurate as you scale your home service business from the $1 million range into the $5 million range and beyond.

When Software Doesn’t Sync: The Phantom Revenue Trap

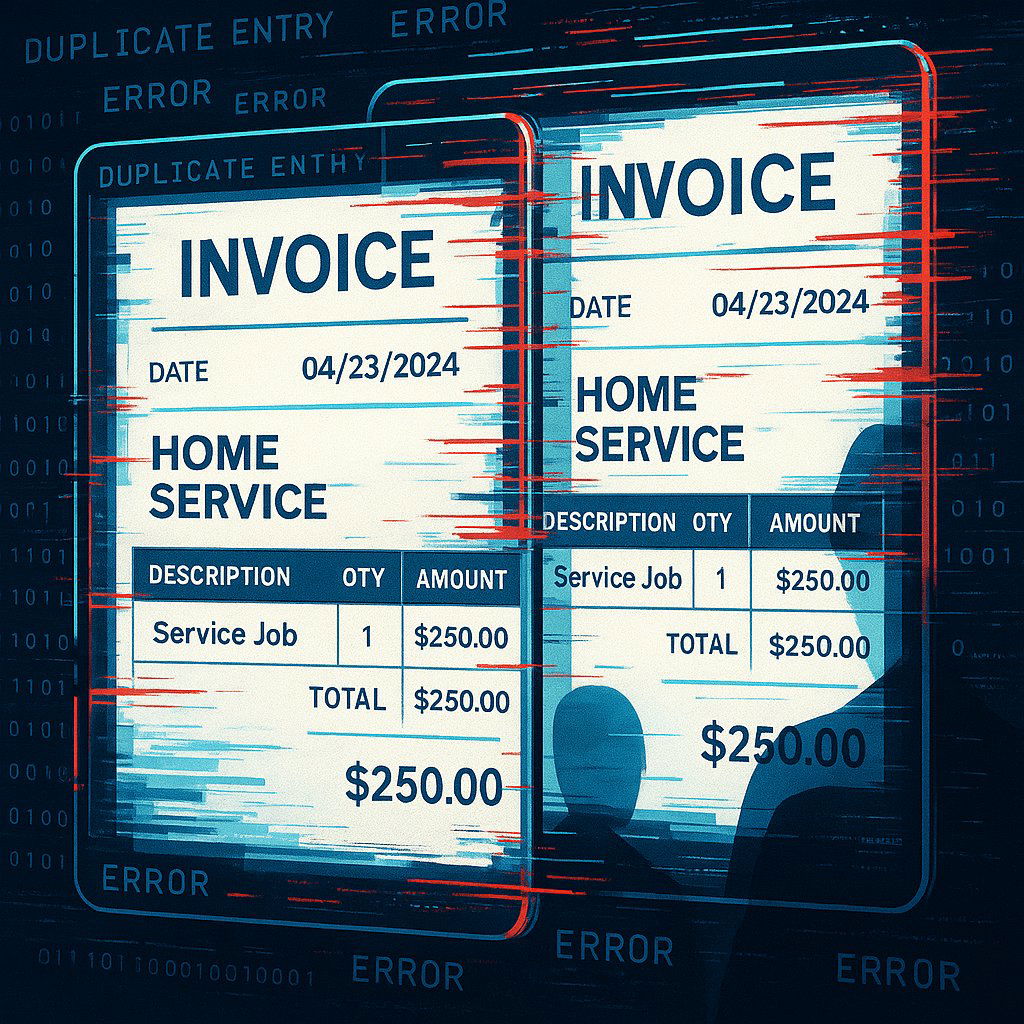

Running a home service company often means juggling multiple software tools. You might use one platform for scheduling jobs and invoicing customers and another (QuickBooks) for your accounting and financial reports. These tools usually integrate, syncing invoices and payments automatically. But what happens when the sync isn’t set up correctly or fails? One common outcome is duplicate entries, where the same income or transaction is recorded twice in QuickBooks bernsteinfinancial.com cpabr.com . For example, an invoice might be created in your job management app and then imported into QuickBooks, and later a bank deposit for that payment is also recorded separately. Now QuickBooks thinks you made two sales instead of one. This “phantom revenue” inflates your income on paper without a dime of extra money in your bank account.

Integration glitches or user errors during syncing can easily produce false revenue entries. Perhaps a slight difference in client name or invoice number causes QuickBooks to treat a synced invoice as new rather than matching it to the existing one. Or maybe a payment that was recorded in the field service app isn’t properly applied to the QuickBooks invoice, leaving the invoice marked as unpaid while the deposit still shows up as income. The result? Your financial statements become unreliable—showing money that you never actually earned or received. According to accounting experts, duplicate transactions distort key reports like profit & loss statements and balance sheets, misrepresenting your business’s true performance bernsteinfinancial.com . It’s a hidden trap: you might feel business is booming because QuickBooks says revenue is up, when in reality those numbers are a mirage caused by bookkeeping errors.

Why is this so dangerous? For one, you could end up making decisions based on those inflated figures. A home services contractor might see a big profit on paper and decide it’s time to invest in a new truck or hire more employees, not realizing the profit is overstated. By the time you catch the mistake, you’ve spent cash that wasn’t truly available. Moreover, inaccurate financials mask real issues—you might not realize some jobs are actually unprofitable or certain customers haven’t paid, because the books are muddled. In short, bad data leads to bad decisions. As one controller candidly put it, the issue is not lack of business savvy, but “we lack clean processes” centime.com . When your software systems don’t sync properly, it creates chaos that even the smartest owner can’t decipher without proper bookkeeping controls.

Inflated Profits Today, Tax Troubles Tomorrow

Phantom revenue doesn’t just mislead you—it also misleads the tax authorities. Small businesses often operate on tight margins, and no owner wants to give Uncle Sam a dollar more than necessary. But if your books show inflated profits due to bookkeeping mistakes, you will be taxed on those nonexistent profits if they aren’t corrected in time. In fact, one financial advisory firm warns that duplicated income or other double entries can inflate your taxable income, leading to potential IRS scrutiny or paying taxes on money you never actually received bernsteinfinancial.com . Put simply, over-reporting income means over-paying taxes—an unnecessary hit to your bottom line.

Consider how this might play out: Let’s say your lawn care business’s accounting records mistakenly counted an extra $50,000 of revenue last year because of a syncing error. At tax time, that $50,000 gets added to your taxable income. Unless you spot and fix the error, you could end up cutting a hefty check for income tax on $50k that never came into your bank. As one accounting expert put it, if you don’t adjust your records to reality, “you’re going to pay taxes on income you never received” driveninsights.com . This scenario is more common than you’d think. For example, small business bookkeeping consultants note that overlooking duplicated deposits or sales will directly cause you to pay more in taxes szwedaconsulting.com . It’s literally like throwing money away—money that could have been reinvested in your business or saved for a rainy day.

Major tax liabilities can also arise if syncing issues cause underreporting of income, though in home services the danger tends to be overreporting through duplicates. Underreporting (missing income) triggers penalties and interest from the IRS, while overreporting means you’re overpaying tax unnecessarily. Neither outcome is good. And even if you catch the error later and file an amended tax return to get a refund, that’s time and money wasted on accounting fees, not to mention possible red flags with tax authorities. No growing business in Orange County or anywhere else needs that kind of headache. The cost of bad bookkeeping can far exceed the cost of doing it right in the first place.

Furthermore, inconsistent books can lead to audit risks. Discrepancies between what your accounting software reports and what’s actually in your bank account are exactly the kinds of things that can draw scrutiny. Duplicate income entries, for instance, might inflate your profit margins oddly or make your cash flow statement not reconcile with bank records—potential red flags in an audit. Accounting professionals warn that duplicate transactions not only mess up reports and taxes but can also pose audit compliance risks cpabr.com . In short, inflated profits on paper today can become very real problems tomorrow when the tax man comes knocking.

Customer Relations at Risk: Chasing Payments That Were Already Collected

Bad bookkeeping doesn’t only hurt your finances—it can damage your reputation and customer relationships as well. One of the hidden dangers of unsynchronized systems is incorrect accounts receivable information. If your invoicing software and QuickBooks aren’t aligned, you might think a customer hasn’t paid when they actually have. For instance, say a client paid you through your field service app, but that payment didn’t properly record in QuickBooks—maybe the payment was logged under a slightly different customer name or there was a duplicate invoice in QuickBooks that remains unpaid. Your aging accounts receivable report in QuickBooks will show a balance due, and you or your office manager might start sending past-due notices or making collection calls to a client who is, understandably, not happy about it.

Few things undermine a client’s trust more than being told they owe money when they don’t. It signals disorganization and can make your business look unprofessional. Unfortunately, this scenario is a real risk when your bookkeeping is inaccurate. QuickBooks error reports and accounting forums are filled with examples of business owners scratching their heads over why paid invoices are still showing as open. The cause is often a bookkeeping mismatch—for example, someone entered a bank deposit in QuickBooks without matching it to the proper invoice. This creates the illusion of income (the deposit) while leaving the invoice unpaid in the system. According to a CPA from a leading firm, failing to match deposits to invoices can result in paid invoices appearing on the accounts receivable report, meaning you might end up billing clients for invoices they’ve already paid cpabr.com . In other words, you could be chasing ghosts—or worse, irritating good customers with erroneous bills.

Duplicate entries (or “double downloads”) in accounting records can inflate income and leave invoices marked unpaid, leading to confused collections.

It’s easy to see how this kind of mistake can damage your company’s reputation. Home service businesses thrive on word-of-mouth and repeat customers. If a plumbing or HVAC client in Orange County keeps getting incorrect late notices because your books are out of sync, they may think twice about hiring you for the next job or referring you to a neighbor. Beyond the customer service aspect, there’s an internal cost too: time and stress. You and your staff could waste hours trying to track down payments, reconcile which invoices are real, and apologizing to customers for “the mix-up.” This is time that could have been spent on productive activities (like actually providing services or marketing your business) instead of untangling accounting errors. As one finance software company noted, misapplied payments can “snowball into confused collections,” where you’re inefficiently chasing money that’s already in the bank centime.com . In summary, bad bookkeeping doesn’t just hit your P&L; it can alienate your clientele and sap your team’s morale.

Small Errors, Big Problems: Why Accuracy Matters as You Scale

If your home services business is aiming to grow from the low millions into a larger operation, accurate bookkeeping only becomes more critical. The stakes get higher with growth: more jobs, more invoices, more transactions—and more potential for errors if you don’t have solid systems. Many $1–5M service businesses start out handling books in-house (perhaps the owner or a spouse doing the basics) and using out-of-the-box software integrations. This might work at a small scale, but as volume increases, those “small” mistakes can compound rapidly. Think of bookkeeping errors like a leak in a pipe—a slow drip might not cause much damage at first, but over time it can flood your whole house.

One reason growing companies run into trouble is process overload. When you’re busy, it’s tempting to take shortcuts with bookkeeping—for example, quickly adding a deposit in QuickBooks because you see it in the bank, without taking the time to match it to an invoice or check if the sales app already recorded it. Or you might postpone reconciling your accounts because you’re focused on fulfilling orders and managing employees. Unfortunately, these shortcuts lay the groundwork for larger financial discrepancies. According to one CPA, letting errors linger or processes lapse can put businesses at risk of noncompliance, tax errors, and ill-advised decisions based on faulty data cpabr.com . In contrast, companies that prioritize regular bookkeeping reviews tend to catch issues early before they explode.

Another factor is multiple systems not fully integrated. If your scheduling, invoicing, payment processing, and accounting platforms all operate separately (or only partially sync), there are more touchpoints where human error can creep in. Data might be exported from one system and imported to another, or manually re-entered in places. Every extra step is a chance to introduce mistakes. As one report observes, when QuickBooks doesn’t seamlessly sync with other tools, staff end up re-keying data or massaging spreadsheets, and “every manual touchpoint introduces the chance for error” centime.com . In a growing home service business, you might have tens of thousands of dollars flowing through your accounts each month. A 1% error rate—which might seem minor—can translate into hundreds of dollars misreported. In fact, studies have shown a significant portion of businesses admit to invoice error rates above 1%, which makes controllers and bookkeepers justifiably concerned centime.com . The bottom line is that scaling requires a tighter grip on financial accuracy. Lenders, investors, or buyers (if you ever seek financing or plan to sell the business) will scrutinize your financial statements. Messy books could derail a deal or increase your cost of capital. Even internally, you can’t chart a path to growth if your compass (the financial data) is broken.

Finally, consider the opportunity cost of bad bookkeeping. As a business owner, your time is precious. Every hour spent untangling accounting errors or deciphering incorrect reports is an hour not spent on strategy, training your team, or serving customers. By investing in sound bookkeeping practices now, you actually free yourself to focus on growth. Accuracy in the books translates to confidence in decision-making—you can bid on that big contract or open a new service area knowing the numbers support it. On the flip side, if your financials are unreliable, you may either hesitate to grow (out of fear something’s off) or grow recklessly on a false foundation.

Best Practices for Clean Books and Synced Systems

The good news is that the dangers of bad bookkeeping can be avoided with some disciplined practices and smart use of technology. Here are some best practices to keep your home service company’s finances accurate and in sync:

- Reconcile accounts regularly (monthly at minimum): Reconciliation is the process of comparing your QuickBooks records with your actual bank and credit card statements to ensure everything matches. This step is non-negotiable if you want to catch errors. It’s often the only way to catch duplicate transactions or deposits that would otherwise slip by szwedaconsulting.com . Many owners skip this because it seems tedious or they assume the software is doing it automatically. In reality, clearing your bank feed is not the same as a true reconciliation. Make it a habit to formally reconcile every account each month—it’s your last line of defense against inaccuracies and overpaying Uncle Sam in taxes szwedaconsulting.com . If something doesn’t tie out, investigate immediately rather than forcing a “plug” entry.

- Match every payment to an invoice (and every deposit to a payment): When using QuickBooks, never just add a bank deposit as income without linking it to the corresponding customer invoice. Always use the “Receive Payment” function or bank feed matching to apply incoming payments to open invoices. This ensures the invoice is marked as paid and the income isn’t recorded twice cpabr.com . By matching deposits to invoices, you prevent situations where QuickBooks shows an invoice unpaid (because a deposit was never applied) at the same time as it shows income from that deposit—a double-counting error. If you use an external invoicing system, make sure you follow its recommended sync procedures for payments. Typically, the workflow should be: invoice in service software → payment recorded (either in service software or QuickBooks, but not both separately) → deposit recorded by QuickBooks via bank feed and matched to that payment. Consistency in this workflow will eliminate most duplicate income issues.

- Review accounts receivable (A/R) aging reports frequently: At least monthly, run an A/R aging report in QuickBooks (or your system of choice) and cross-check it against your operational records. Look for any invoices that are overdue or showing unpaid that you believe were paid. This can clue you in to invoices that might have fallen through the cracks or payments that didn’t sync. If you find any, investigate and resolve them—either apply the missing payment, delete a duplicate invoice, or reach out to the customer if it is legitimately unpaid. Staying on top of A/R will prevent the embarrassment of accidentally pursuing a customer for an invoice they’ve settled. It also helps you spot genuine late payments that you do need to follow up on (improving cash flow).

-

Use one source of truth for invoicing: To avoid confusion, decide whether your field service management software or QuickBooks will be the primary place where invoices are generated and closed out. When possible, let one system drive the process and the other mirror it. For example, you might create and send all invoices from your job management app, which then syncs them to QuickBooks for accounting purposes. In that case, don’t also create invoices manually in QuickBooks—that would almost guarantee duplicates. Likewise, record customer payments in only one system to start (the one that syncs to the other). Having a single source of truth for each type of data (clients, invoices, payments) will minimize contradictory entries. If your systems don’t talk to each other in some area, consider integrating them (or even using an automation tool like Zapier) to reduce manual data entry, since manual re-entry is prone to error centime.com .

- Perform regular financial reviews and sanity checks: Don’t wait until tax season to look closely at your financial statements. Do a monthly or quarterly review of your profit and loss statement, balance sheet, and cash flow. See if the revenue numbers make sense relative to the number of jobs you completed and deposits in the bank. If something looks off (e.g., profit margin inexplicably high, or revenue total higher than expected), dig into the details. You might catch a duplicated invoice or an expense that was misrecorded. One small business accountant advises that reviewing reports monthly can help spot “worrying trends” or discrepancies early on szwedaconsulting.com . It’s much easier to fix a mistake from last week than a mistake from 11 months ago after the year has closed.

- Write off uncollectible receivables and adjust your books: Home service businesses sometimes have to deal with bad debts—perhaps a customer declares bankruptcy or disputes a charge you can’t collect. If an invoice is truly uncollectible, don’t leave it hanging on the books forever, as this will overstate your income. Work with your bookkeeper or accountant to write it off properly in QuickBooks (usually by using a credit memo or bad debt expense). This adjustment ensures your revenue is reported accurately. Remember, if you leave a long-overdue invoice on the books under accrual accounting, you’re essentially claiming income you’ll never get, which means paying tax on that phantom income driveninsights.com . Pruning your A/R of uncollectible items keeps your financial picture honest.

-

Invest in bookkeeping expertise or training: As your business grows past the $1M mark, the complexity of your finances usually grows too. It can be a smart investment to hire a professional bookkeeper or an accountant (even part-time or outsourced) to oversee your books szwedaconsulting.com . They can ensure your QuickBooks is set up correctly, your integrations (with whatever field service software you use) are functioning, and your accounts are reconciled. If hiring someone is not feasible yet, consider getting specialized QuickBooks training for yourself or your office manager. The software is powerful but has nuances—a little training can prevent a lot of mistakes. Remember, what you save by avoiding professional help you might lose many times over in errors, missed deductions, or tax problems if you go it alone. Businesses that work with professional bookkeepers often see better financial outcomes, including higher profit margins, because their finances are managed right.

By implementing these practices, you build a safety net for your business’s financial health. The goal is to have your operational tools (scheduling, CRM, invoicing apps, etc.) and your accounting system working in harmony, with processes that catch errors before they become serious issues.

Conclusion: Accuracy is the Best Policy

Bad bookkeeping may not show its consequences immediately—it’s a hidden danger that lurks until a crisis forces it into the light. But as we’ve seen, the risks are very real: paying thousands in taxes on phantom income, getting an inflated sense of your profits, souring customer relationships with billing mistakes, and even jeopardizing your growth plans. Home service businesses in competitive markets like Orange County can’t afford to operate on faulty financial information. The good news is that by staying vigilant and proactive about your bookkeeping, you can avoid these pitfalls.

Think of accurate books as the foundation of your house: everything is built upon it. With clean, reconciled, and truthful financial records, you’ll have a clear view of how your business is truly performing. You’ll make decisions with confidence, secure in the knowledge that your revenue isn’t overstated and your cash flow is real. Come tax time, you’ll sleep easier knowing you’re reporting correctly—no more nasty surprises or overpayments. And when it comes to your customers, you’ll maintain trust by billing correctly and fairly, never having to make awkward apologies for accounting mix-ups.

In summary, bookkeeping accuracy is not a luxury but a necessity for any home service company looking to scale past the early stages. By understanding the hidden dangers of bad bookkeeping and taking steps to sync your systems and reconcile your accounts, you protect your business’s money, reputation, and future. It may require a bit more effort or investment in the short term, but the payoff is huge: you get to focus on growing your business, armed with reliable financial insight, and leave the phantom revenues and ghost invoices behind. Your company—and your customers—will thank you for it.

Sources:

- Bernstein Financial Services – QuickBooks: Duplicate Entries & How To Avoid Them (bookkeeping best practices and issues with double entries) bernsteinfinancial.com

- Boyer & Ritter CPAs – 9 Common QuickBooks Errors and How to Fix Them (duplicate transactions, reconciliation issues, and matching deposits to invoices) cpabr.com cpabr.com

- Driven Insights – Year-End Financial Statement Prep Shortcuts (dangers of over-reporting income and paying tax on unreceived revenue) driveninsights.com

- Szweda Consulting – 5 Common Bookkeeping Mistakes Small Businesses Make (importance of regular reconciliations to catch duplicate deposits and avoid overpaying taxes) szwedaconsulting.com szwedaconsulting.com

- Centime (Finance Blog) – Finance Automation for QuickBooks (on integration gaps and manual errors when systems don’t sync) centime.com

Stay ahead in a rapidly world. Subscribe to Prysm Insights,our monthly look at the critical issues facing global business.